Vacuum Insulated Glass (VIG):

Achieves U-values as low as 0.4 W/(m²·K) , outperforming traditional double glazing (typically 1.0–2.8 W/(m²·K)).

Utilizes a vacuum-sealed gap (≤0.2 mm) to eliminate convective heat transfer, critical for meeting stringent standards like China's GB/T51350-2019 and the EU's EPBD III .

Traditional Double Glazing:

Relies on inert gas (argon/krypton) filling and wider spacers (12–24 mm).

Suffers from gradual gas leakage, reducing U-value efficiency by 15–20% over 10 years.

Thickness & Weight:

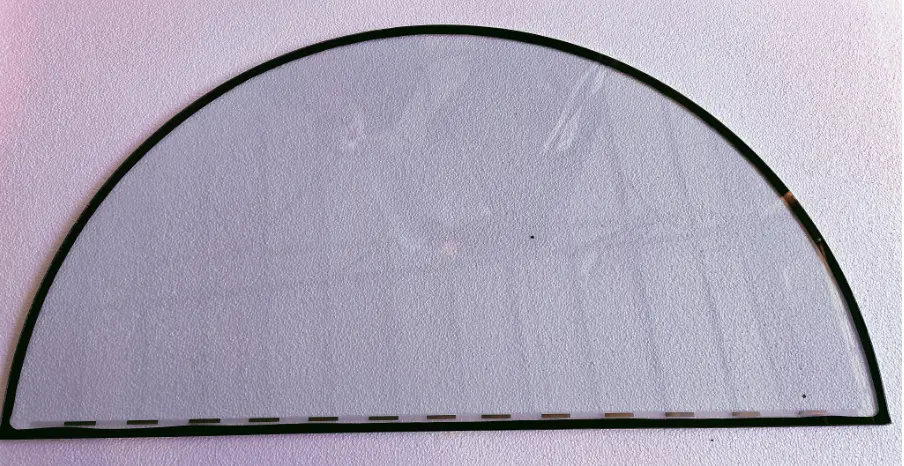

VIG panels are 60% thinner (total thickness: 6–8 mm vs. 24–36 mm for double glazing), enabling retrofitting in heritage buildings .

Weight reduction (≤20 kg/m²) minimizes structural reinforcement needs.

Noise Reduction:

VIG achieves 42 dB sound insulation due to vacuum layer damping, surpassing double glazing's 35 dB.

Initial Costs:

VIG costs ~$75/m² (2025 projection), 2.5× higher than standard double glazing. However, Chinese suppliers like Jinan evergreen glass have reduced production costs by 58% since 2015 through advanced laser sealing .

Lifetime Savings:

Energy savings offset VIG's premium within 7–10 years in cold climates.

Maintenance costs drop by 30% as VIG avoids spacer degradation and gas replenishment.

Leading vacuum insulated glass suppliers differentiate through:

Production Scale: Chinese manufacturers (e.g., Beijing Xinliji) contribute 75% of global VIG capacity, ensuring 4-week lead times for bulk orders .

Certifications: ISO 9001, CE, and ASTM E2190 compliance are mandatory for EU/US market entry.

Customization: Suppliers now offer tempered VIG-laminated composites with 19J impact resistance for safety-critical applications .

Fragility Concerns: VIG's edge-sealing remains vulnerable during transport; suppliers mitigate this with non-symmetric stress-balance packaging .

Skill Gaps: 68% of installers lack vacuum glass handling training, increasing breakage risks.

Vacuum insulated glass suppliers are driving a paradigm shift in building glazing. While VIG's upfront costs remain higher, its superior thermal performance and lifespan ROI make it indispensable for zero-energy projects. Strategic partnerships with certified suppliers (prioritizing ISO/CE compliance and ESG alignment) will be critical for architects and developers navigating 2025 carbon tariff regulations.

For technical specifications or supplier shortlists, consult info@evergreenglass.com .